Determining US Stock Market and US Economy Recession Cycles Using Annual Lunar Calendar Chart Method

Article Researched, Written, and Shared by Rao Nemani

Compiled by Rocky Jamwal

Introduction to US Stock Market and Recession Cycle

As per the us stock market analysis and National Bureau of Economic Research, a recession is defined as “A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales”. Americans have experienced these recession cycles in the past many years in USA, but most importantly, the business and working class people are effected by the Corporations spend and downsizing of workforce / resources during the recession time. So, in this paper, I would like to share a method to determine USA Recession Cycles using Annual Lunar Calendar Chart casted by taking the Capital city of the USA, Washington, DC.

The US stock market is a cornerstone of the global financial system, providing a platform for trading securities and acting as a barometer of overall economic health. Its roots date back to the late 18th century, when the New York Stock Exchange (NYSE) was founded in 1792. Today, the NYSE is one of the world’s largest stock exchanges, along with other major US exchanges such as NASDAQ. These exchanges facilitate stock buying and selling, acting as intermediaries between buyers and sellers.

Stock indices such as the Dow Jones Industrial Average (DJIA) and the S&P 500 are essential features of the US stock market. The DJIA, composed of 30 significant companies, provides a snapshot of the market’s performance, while the S&P 500 includes 500 leading companies and offers a broader market perspective. These indices help investors gauge market trends and make informed investment decisions.

Economic indicators, fiscal policies, and geopolitical events influence the US stock market, which plays a critical role in the global economy. It serves as a platform for companies to raise capital by issuing shares to the public. Companies can use this capital for expansion, research, development, and other business activities that contribute to economic growth. In addition, global investors look to the US stock market for robust investment opportunities.

Basic terminologies such as’stocks,’ ‘bonds,’ and’market ‘capitalisation’ are fundamental to understanding the US stock market. Stocks represent ownership shares in a company, granting investors equity in the company’s earnings and assets. Bonds, on the other hand, are debt instruments through which investors lend money to corporations or governments in exchange for regular interest payments. Other investment vehicles include mutual funds, ETFs, and derivatives, each offering different risk-return profiles.

Understanding the dynamics of the US stock market is crucial for investors, whether they are novices or experienced traders. This section aims to provide a comprehensive introduction to its history, significance, and operations, laying the foundation for deeper exploration into its various facets.

Factors influencing the US Stock Market

Numerous factors influence the performance of the US stock market, each contributing in different ways to market trends and fluctuations. Economic indicators are one of the most important influences. Key metrics, such as Gross Domestic Product (GDP) growth, provide insight into the overall health and expansion of the economy. A robust GDP generally correlates with a bullish stock market, while stagnation or contraction can lead to bearish trends.

Interest rates, determined by the Federal Reserve, also play a critical role. When interest rates are low, borrowing becomes cheaper, potentially spurring economic activity and driving stock prices higher. Conversely, rising interest rates can increase borrowing costs, possibly cooling economic growth and leading to a decline in stock prices.

Inflation is another crucial factor. Moderate inflation is often indicative of a growing economy, but rampant inflation can erode purchasing power, leading to higher costs for companies and consumers alike, negatively impacting corporate profits and stock valuations. Employment figures similarly offer a gauge of economic strength. High employment typically supports consumer spending, which is vital for economic and stock market growth.

Corporate earnings reports are pivotal as they reflect the financial health of companies. Positive earnings often boost investor confidence and stock prices, while disappointing results can lead to market downturns. Geopolitical events, including trade wars, elections, and international conflicts, can introduce uncertainty, impacting investor sentiment and market stability.

Government policies, such as tax reforms and spending initiatives, also exert influence on the stock market. Pro-business policies may spur investment, whereas regulatory uncertainty can hinder market performance. Technological advancements drive innovation and productivity, often leading to sector-specific surges in stock prices.

Finally, we cannot undervalue the importance of investor sentiment and market psychology. Collective behavior often drives market trends, with optimism or fear leading to market rises or falls. Understanding these multifaceted influences provides a comprehensive view of what drives the US stock market, equipping investors with the knowledge to navigate its complexities.

Introduction to Lunar Calendar Chart Method

The Lunar Calendar Chart Method, though often underestimated, has a rich historical significance in various aspects of life, including financial market analysis. This method, based on lunar cycle observation, has long been used by cultures to predict natural and human activities. Historically, cultures have used lunar cycles to determine optimal planting seasons, navigate tides, and even anticipate market trends.

The moon’s phases, particularly the new moon and full moon phases, are central to the lunar calendar chart method. Researchers have observed that these lunar phases carry potential influences on human psychology and behavior, which could subsequently affect market activities. For instance, periods around the new moon are often thought to be conducive to new beginnings and optimism, potentially leading to increased buying behaviors. Conversely, full moon periods might trigger caution or pessimism, resulting in more conservative financial decisions or market sell-offs.

The idea that lunar cycles have an impact on human behavior has some roots in empirical research. Scholars in various fields, including psychology and astronomy, have explored the moon’s gravitational pull and its correlation with psychological states. These subtle shifts in human sentiment can sometimes manifest themselves in collective behaviours that drive market movements. Financial market analysts utilizing the Lunar Calendar Chart Method aim to map these cyclical patterns in hopes of gaining a predictive edge.

While this approach may seem esoteric, its application in financial market analysis is part of a broader tradition of examining cyclical phenomena to forecast economic activity. By integrating data on lunar phases with traditional stock market analysis, this method seeks to provide a more nuanced understanding of market behaviors. In doing so, it offers an intriguing perspective on the interconnectedness of natural cycles and economic trends.

The correlation between lunar phases and US Stock market trends

Over the years, various empirical studies and anecdotal evidence have pointed to a potential correlation between lunar phases and stock market trends. Several researchers have explored how lunar cycles, particularly new moons and full moons, can influence market behavior. Historical data suggests that these celestial events can indeed have a subtle yet detectable impact on stock prices, sometimes contributing to market gains or declines.

A number of scholarly studies have quantified the relationship between lunar phases and stock market performance. One such study found that stock returns tend to be abnormally high around new moons and relatively low around full moons. This phenomenon has been attributed to psychological factors, such as investor sentiment and market psychology, which are thought to be influenced by lunar phases. Although the exact mechanisms remain elusive, the statistical evidence is strong enough to warrant further investigation.

Traders and economists often use a variety of statistical methods and indicators to identify patterns linked with lunar phases. Techniques such as time-series analysis and Fourier transforms have been useful in isolating cyclical patterns in market data. Additionally, some financial models incorporate lunar cycle indicators as part of a broader strategy, leveraging the timing of new and full moons to optimise buy and sell decisions.

Despite the skepticism of the mainstream financial community, we cannot entirely dismiss the wealth of anecdotal evidence. Historical market records from different time periods and geographical regions show recurrent patterns that align with the lunar calendar. This convergence of folklore and statistical rigour offers a rich field for further academic inquiry and practical application.

In essence, although there is not universal acceptance of the correlation between lunar phases and market trends, the data sufficiently supports the notion to warrant consideration. It will be fascinating to see how traders and economists integrate lunar cycles into more comprehensive market analysis frameworks as they continue to study this intriguing relationship.

Case Studies: Past US Economic Recession Cycles and Lunar Calendar

Examining past US recessions through the lens of the lunar calendar yields fascinating insights into the potential predictive capabilities of this alternative method. Historical analysis reveals several instances where the alignment of economic recessions with lunar cycles is noteworthy. These case studies provide a comprehensive understanding of the application of the lunar calendar method to predict market downturns and recoveries, despite a range of successes and challenges.

A prominent case study is the 2008 financial crisis. In the years leading up to this significant economic downturn, researchers observed that certain lunar phases—notably the new moon—coincided with increased market volatility. Analysts in certain circles anticipated heightened risks around these periods. While this did not provide absolute foresight into the crisis, it underscored moments of caution preceding the downturn. Additionally, the re-emergence of market stability post-crisis corresponded with lunar phases, reinforcing a degree of predictive value.

Similarly, during the early 2000s dot-com bubble, the lunar calendar suggested cautionary signals. Researchers pointed to specific lunar phases where irrational exuberance was most prominent. The alignment highlighted an overvaluation in tech stocks and foreshadowed a correction, which later manifested as a major market collapse. Although the timing was not precise, the correlation between lunar phases and economic sentiment during this period provided a compelling case for consideration.

On the flip side, one must acknowledge the limitations inherent to this method. The 1987 Black Monday crash serves as an illustrative example where the lunar calendar offered limited predictive utility. Despite significant lunar phases, the abrupt market downturn was unforeseen within this framework, emphasizing the inherent unpredictability and multifaceted nature of economic phenomena.

Ultimately, these case studies highlight both the potential foresight and notable constraints of utilising the lunar calendar to predict economic recessions. While the lunar calendar can occasionally signal periods of caution or optimism, we should employ it as a supplementary tool rather than a standalone predictive measure.

Practical application and future implications on Recession Cycle & US Stock Market Analysis

Integrating the lunar calendar method into trading or economic forecasting strategies can provide a unique perspective for investors and analysts. One of the fundamental steps in this process is acquiring the right tools and resources. Contemporary software platforms and mobile applications offer lunar cycle tracking with precision. Examples include the Moon Phase Calendar and My Moon Phase, which provide detailed lunar phase information that can be paired with market data.

For practical application, it is advisable to create a historical correlation between lunar phases and market performance. This involves back-testing data to identify patterns and constructing models that illustrate potential market reactions during specific lunar phases. Investors should not rely solely on lunar phases, but rather use them as a supplementary tool. Integrating this method with other technical and fundamental analyses—such as moving averages, volume analysis, and economic indicators—enhances decision-making robustness.

Incorporating lunar cycles should involve a disciplined approach, considering both bullish and bearish phases and combining them with broader market trends. For example, traders might observe market positions during a full moon and confirm their insights through traditional methods like the Relative Strength Index (RSI) or candlestick patterns. This holistic strategy aids in minimising risks and identifying market opportunities with greater accuracy.

Future implications of the lunar calendar method in financial markets could be significant, especially with ongoing technological advancements. Artificial intelligence (AI) and machine learning (ML) are innovating market prediction models, and the lunar method can be a novel input in these systems. AI can identify more intricate patterns and generate higher accuracy predictions, thus potentially revolutionising the utility of lunar cycles in trading strategies.

Moreover, changing market dynamics in the context of globalisation and algorithmic trading accentuate the need for diverse analytical approaches. The lunar calendar method could evolve to accommodate this environment’s complexity, offering an additional layer of analysis to the increasingly sophisticated tools used by market participants. As market dynamics continue to evolve, the lunar calendar method’s role may grow, fostering new approaches in financial analysis and trading practices.

Decoding US Stock Market, recession and Economic Crunch Astrologically

I have used the following pointers and illustrated the principles with USA Recession Cycles Since 1960 Charts to demonstrate its application.

Principles:

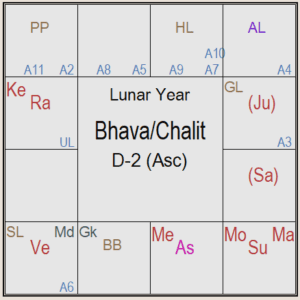

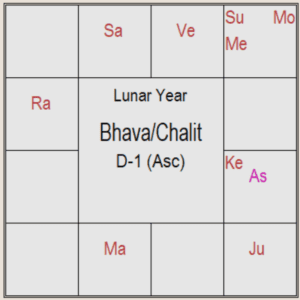

1) Rasi (D-1) Lagna Lord, 2nd Lord and their placement in Dushtana (6th, 8th or 12th) houses.

2) Hora (D-2) Lagna Lord, 2nd Lord and their placement in Dushtana (6th, 8th or 12th) houses.

3) Rahu and Ketu’s involvement and influence with the above 2 principles.

Note: I have used Pushya-Paksha Ayanamsa with Bhava/Chalit Charts in this analysis.

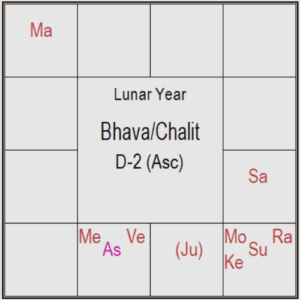

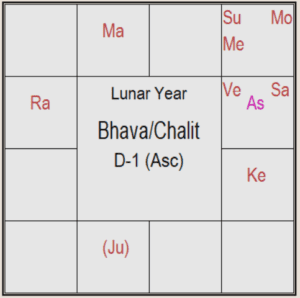

USA Recession-01: Apr 1960 to Feb 1961

* Lunar New Year: July 5, 1959, 22:01:05 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna and 2nd Lord Saturn is placed in 12th house and being aspected by 8th lord Sun. Rahu and Ketu are aspecting Lagna Lord Saturn by Rasi Drishti.

In Hora Chart (D-2), 2nd lord Mars is placed in 12th house with 10th lord Moon and 11th Lord Sun. Mercury the 12th lord is placed in Lagna. Rahu and Ketu are aspecting the D-2 Lagna by Rasi Drishti. The Recession began during the Mars (2nd Lord in D-2) Vimsottari Dasa in April 1960.

USA Recession-02: Dec 1969 to Nov 1970

* Lunar New Year: July 14, 1969, 10:12:03 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna is being afflicted by Rahu and Ketu. Lagna Lord Sun is with 2nd Lord Mercury and 12th lord Moon. Saturn is the 6th Lord and aspecting Lagna lord and 2nd Lord Mercury by 3rd aspect from Aries.

In Hora Chart (D-2), 2nd co-lord Rahu is with Ketu and being aspected by 8th lord Sun. The Recession began during the Ketu (with 2nd Lord Rahu in D-2) Vimsottari Dasa in November/December 1969.

USA Recession-03: Nov 1973 to Mar 1975

* Lunar New Year: July 30, 1973, 07:39:17 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna lord Moon, 2nd Lord Sun, 8th Lord Saturn are placed in 12th house along with Ketu and all these are being aspected by Rahu.

In Hora Chart (D-2) 2nd lord Jupiter is placed in 12th house. 12th Lord Venus and 8th lord Mercury are placed in Lagna. The Recession began during the Jupiter (2nd Lord in D-2) Vimsottari Dasa in July 1973.

USA Recession-04: Jan 1980 to July 1980

* Lunar New Year: June 24, 1979, 07:58:31 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna Lord Moon and 2nd Lord Sun are placed in 12th house. 12th Lord Mercury and 6th Lord Jupiter are placed in Lagna. Ketu is aspecting Lagna by Rasi Drishti.

In Hora Chart (D-2), 2nd lord Jupiter is placed in 12th house. 8th Lord Mercury is placed in Lagna. Rahu and Ketu are aspecting Lagna by Rasi Drishti.

USA Recession-05: July 1981 to Nov 1982

* Lunar New Year: July 1, 1981, 15:03:41 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna Lord Venus is placed in 10th house with Rahu. 2nd Lord Mars is placed with 12th Lord Mercury in 9th house.

In Hora Chart (D-2), 2nd lord Venus is placed in 8th house with Rahu and Ketu. The recession began in Rahu Vimsottari Dasa in July 1981.

USA Recession-06: July 1990 to Mar 1991

* Lunar New Year: June 22, 1990, 14:55:10 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna Lord Mercury is with 12th Lord Sun. 2nd Lord Venus is placed in 8th house. Rahu is aspecting the Lagna Lord Mercury by Rasi Drishti.

In Hora Chart (D-2), 2nd lord Jupiter is placed in 8th house. The recession began in Rahu Vimsottari Dasa in June 1990.

USA Recession-07: Mar 2001 to Nov 2001

* Lunar New Year: July 1, 2000, 15:20:28 (4 Hrs west of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna Lord Venus is with 12th lord Mercury. 2nd Lord Mars is placed with 12th Lord Mercury, 8th Lord Venus in 9th house.

In Hora Chart (D-2), 2nd lord Venus (Debilitated) is placed in 6th house. Rahu and Ketu are aspecting Lagna by Rasi Drishti. The recession began in Venus Vimsottari Dasa in Mar 2001.

USA Recession-08: Dec 2007 to June 2009

* Lunar New Year: July 14, 2007, 08:04:24 (4 Hours West of GMT), Washington, DC (77 W 02′ 12″, 38 N 53′ 42″)

In Rasi Chart, the Lagna Lord Moon is in 12th with 12th lord Mercury. 2nd Lord Sun is also placed in 12th house with 12th Lord Mercury.

In Hora Chart (D-2), 2nd lord Mars is placed in 8th house. Rahu and Ketu are aspecting 2nd Lord Mars by Rasi Drishti. The recession began in Ketu Vimsottari Dasa in December 2007.

Conclusion

We saw how effectively we could use the Annual Lunar Calendar Chart prepared for a given Year for a Country with the principles laid out in the beginning of this article in determining the recession cycles. I sincerely hope my fellow Astrologers will continue to work with these principles, expand these principles and then to help People and Business Organization to prepare for the upcoming recession cycle(s).

References

1) Article “Re-defining the Lunar New Year Chart” by Sri. P.V.R. Narasimha Rao, December 3, 2014 (version 1) :

http://vedicastrologer.org/articles/pp_lunar_year.pdf

2) USA National Bureau of Economic Research: http://www.nber.org/cycles.html

3) USA Recession Cycle Periods from https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

***

Views: 54