Table of Contents

Trading Alert in Stock Market : Saturn & Mercury Movement will bring change in Trends for the coming 10-12 Days

Introduction

Within the context of the global stock market, the week beginning June 3 and ending June 15 brings with it a great deal of unpredictability, a wide range of possibilities, and a variety of investment openings. Primarily, we notice an effect on the stock markets in the United States and India. There is a good chance that the upcoming planetary movement will bring about some interesting developments in the world of finance. This is due to the fact that two significant celestial shifts are going to take place: first, Saturn will enter into a retrograde stationary state beginning on June 5th, and Mercury will go into a stationary direct state beginning on June 3rd and continuing forward. Mercury’s ongoing stationary direct state and Saturn’s retrograde state will have an effect on a variety of commodities related to crude oil, gas, coal, iron, IT, telecom, technology, and financial institutions; it is possible that either there will be an increase in stock prices or there will be chances of a sudden slash in prices of these commodities being seen in the business world as well. Saturn’s retrograde state will remain in effect until the end of the year.

Actual Events of Stock Market

During this stationary motion of slow-moving Saturn and fast-moving Mercury from June 3rd, 2022 onward, both will form an angle of 89 degrees to each other, which will completely change the ongoing short bullish trend towards downward starting from May 23rd, 2022 onward (as already mentioned in my earlier tweets for the short and temporary bullish trend we will see from May 23rd, 2022 onward after Venus movement over the Aries sign).

There will be a sudden shock, break, and fear factor that will apply to the ongoing trend of the stock market. There is a high chance that we can start observing a new bearish trend from June 3rd, 5th, and 6th, onward up to June 11th, 2022. This is because these changes in the celestial sphere will result in fast and slow-moving planets attaining stationary motion.

As the earlier Venus Movement in the Bullish Sign from May 23rd onwards has given a sudden boost or kick in the market’s upward trend, but more Venus will move towards Uranus in Aries around 22 degrees, and there is also a great chance of a sudden upset or sudden bearish trend in the financial world that may begin from June 11th and 12th, though it will be for a shorter period,

Later on, when Venus reaches the degree occupied by Uranus, which is 22 degrees, its passage towards the North Node Rahu will once again produce an upward trend beginning on the 15th of June, 2022, but this time it is possible that this trend will be a shorter one.

The Russia-Ukraine geopolitical situation has already produced inflation in the market over the course of the past two to three months as a direct result of Uranus’s close movement towards North Node Rahu.

The beginning of a pattern in trade

The upcoming shift in trend (from June 3rd to June 11th and 12th, 2022) will be favourable for the information technology sector, telecom, financial institutions, trading sector, and infrastructure stocks, and it will boost the good cash flow in the market. On the other hand, price increases will be observed in steel, crude oil, gas, leather, metal, and other commodities.

People can start observing or investigating the ongoing trend on the 3rd of June 2022, which I have posted on the Twitter :

https://twitter.com/jamwal_rocky/status/1532601400873476096?s=20&t=Xb0-ZAfeDuCGJlEIEc8riw :

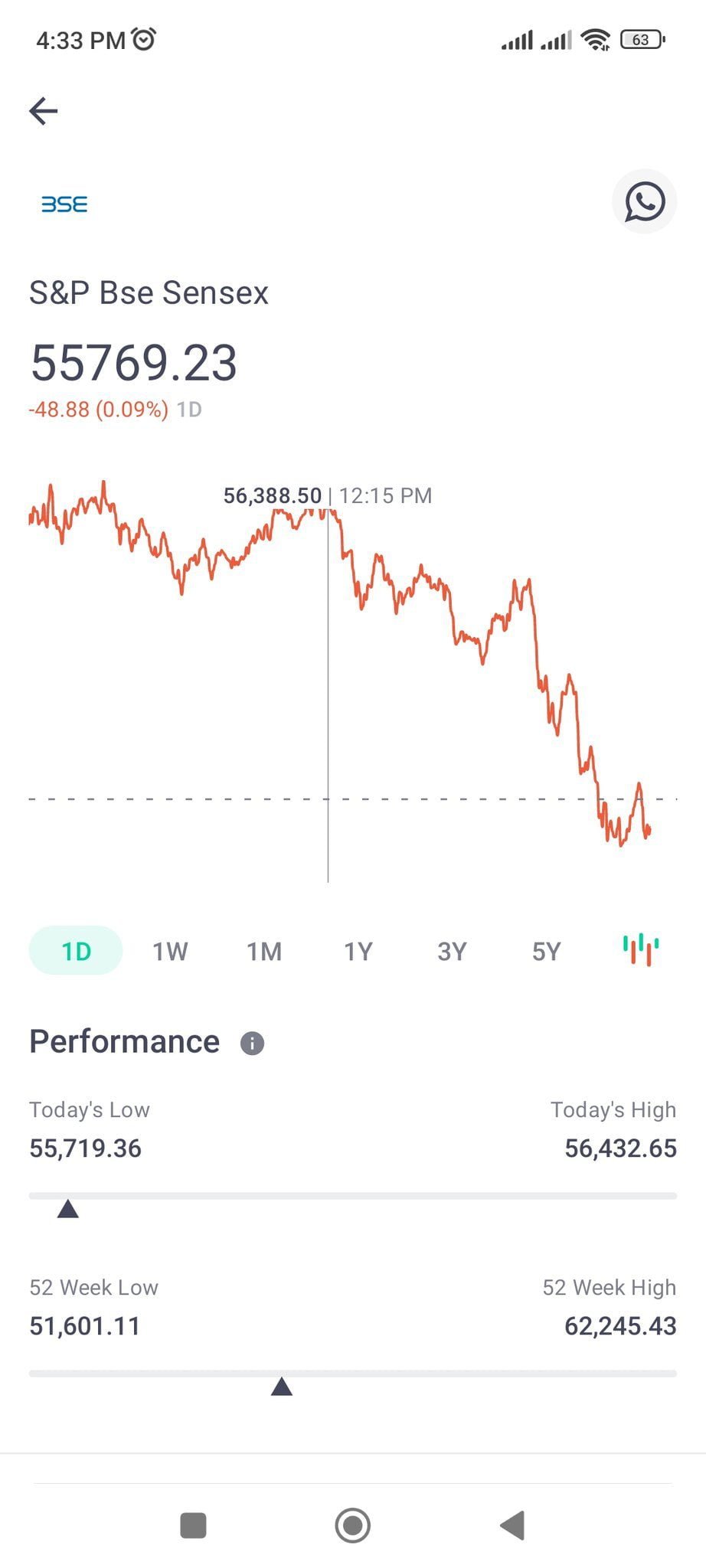

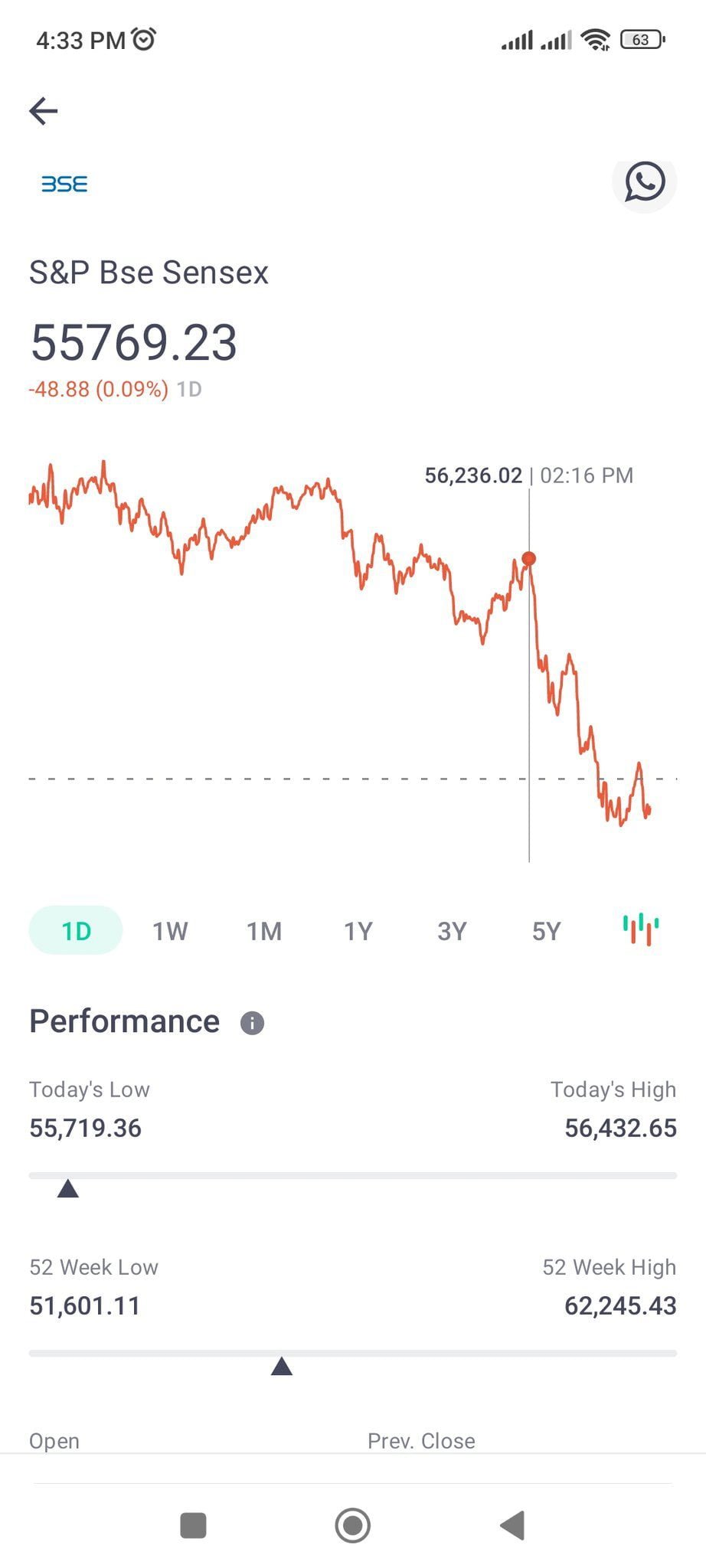

” From Morning 9:15 Onward Buying will be high & Selling/Buying both will be seen high from 12:30 Noon onward Today & Sudden Kick will be observed from 2:15 PM up to 3:30 PM. whereas The period from 2:15 is very crucial for Selling “

After observing the whole day, the Majority of the timings and stock information fall true.

Here are screenshots attached for reference :

So in the end, I can only conclude: Keep on observing the coming 10 days for new trends that can affect the ongoing short bullish trend.

Regards,

Rocky Jamwal.

Views: 50